Rest in Peace, Regg the drummer. Our hearts break as the silence of your presence fills the room. Peace be with you in your final resting place. God knows that we miss you and we love you. Thank you for your love, acceptance and humorous spirit. You were deeply loved my many and will missed by all who knew you. My brother, I love you. Good bye.

Rest in Peace, Regg the drummer. Our hearts break as the silence of your presence fills the room. Peace be with you in your final resting place. God knows that we miss you and we love you. Thank you for your love, acceptance and humorous spirit. You were deeply loved my many and will missed by all who knew you. My brother, I love you. Good bye.Scared-4-America is a blog for political, social commentary, and economic discussions. Scared4America believes in reading, questioning, and speaking truth to power.

3.20.2009

The Silent Drums

Rest in Peace, Regg the drummer. Our hearts break as the silence of your presence fills the room. Peace be with you in your final resting place. God knows that we miss you and we love you. Thank you for your love, acceptance and humorous spirit. You were deeply loved my many and will missed by all who knew you. My brother, I love you. Good bye.

Rest in Peace, Regg the drummer. Our hearts break as the silence of your presence fills the room. Peace be with you in your final resting place. God knows that we miss you and we love you. Thank you for your love, acceptance and humorous spirit. You were deeply loved my many and will missed by all who knew you. My brother, I love you. Good bye.3.19.2009

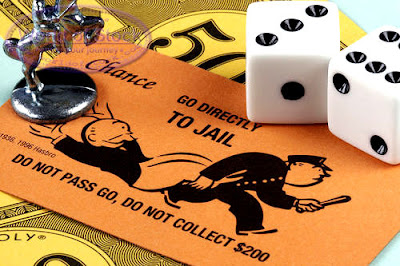

Wall Street Crooks

During my childhood, I (like most kids) played the game Monopoly. As a child, it seemed strange that the first major stop on the corner of the game-board was a "jail."

--by Ron Edwards

3.18.2009

The 1994 Orange County Bankruptcy

Eliot Spitzer Weighs in on AIG

Everybody is rushing to condemn AIG's bonuses, but this simple scandal is obscuring the real disgrace at the insurance giant: Why are AIG's counterparties getting paid back in full, to the tune of tens of billions of taxpayer dollars?

Everybody is rushing to condemn AIG's bonuses, but this simple scandal is obscuring the real disgrace at the insurance giant: Why are AIG's counterparties getting paid back in full, to the tune of tens of billions of taxpayer dollars? For the answer to this question, we need to go back to the very first decision to bail out AIG, made, we are told, by then-Treasury Secretary Henry Paulson, then-New York Fed official Timothy Geithner, Goldman Sachs CEO Lloyd Blankfein, and Fed Chairman Ben Bernanke last fall. Post-Lehman's collapse, they feared a systemic failure could be triggered by AIG's inability to pay the counterparties to all the sophisticated instruments AIG had sold. And who were AIG's trading partners? No shock here: Goldman, Bank of America, Merrill Lynch, UBS, JPMorgan Chase, Morgan Stanley, Deutsche Bank, Barclays, and on it goes. So now we know for sure what we already surmised: The AIG bailout has been a way to hide an enormous second round of cash to the same group that had received TARP money already.

It all appears, once again, to be the same insiders protecting themselves against sharing the pain and risk of their own bad adventure. The payments to AIG's counterparties are justified with an appeal to the sanctity of contract. If AIG's contracts turned out to be shaky, the theory goes, then the whole edifice of the financial system would collapse.

But wait a moment, aren't we in the midst of reopening contracts all over the place to share the burden of this crisis? From raising taxes—income taxes to sales taxes—to properly reopening labor contracts, we are all being asked to pitch in and carry our share of the burden. Workers around the country are being asked to take pay cuts and accept shorter work weeks so that colleagues won't be laid off. Why can't Wall Street royalty shoulder some of the burden? Why did Goldman have to get back 100 cents on the dollar? Didn't we already give Goldman a $25 billion capital infusion, and aren't they sitting on more than $100 billion in cash? Haven't we been told recently that they are beginning to come back to fiscal stability? If that is so, couldn't they have accepted a discount, and couldn't they have agreed to certain conditions before the AIG dollars—that is, our dollars—flowed?

The appearance that this was all an inside job is overwhelming. AIG was nothing more than a conduit for huge capital flows to the same old suspects, with no reason or explanation.

So here are several questions that should be answered, in public, under oath, to clear the air:

- What was the precise conversation among Bernanke, Geithner, Paulson, and Blankfein that preceded the initial $80 billion grant?

- Was it already known who the counterparties were and what the exposure was for each of the counterparties?

What did Goldman, and all the other counterparties, know about AIG's financial condition at the time they executed the swaps or other contracts? Had they done adequate due diligence to see whether they were buying real protection? And why shouldn't they bear a percentage of the risk of failure of their own counterparty? - What is the deeper relationship between Goldman and AIG? Didn't they almost merge a few years ago but did not because Goldman couldn't get its arms around the black box that is AIG? If that is true, why should Goldman get bailed out? After all, they should have known as well as anybody that a big part of AIG's business model was not to pay on insurance it had issued.

- Why weren't the counterparties immediately and fully disclosed?

Failure to answer these questions will feed the populist rage that is metastasizing very quickly. And it will raise basic questions about the competence of those who are supposedly guiding this economic policy.

3.17.2009

Rage at AIG Swells As Bonuses Go Out

"It's a mob effect," one senior executive said. "It's putting people's lives in danger."

Politicians and the public spent yesterday demanding that AIG rescind payouts that they said rewarded recklessness and greed at a company being bailed out with $170 billion in taxpayer funds. But company officials contend that the uproar is scaring away the very employees who understand AIG Financial Products' complex trades and who are trying to dismantle the division before it further endangers the world's economy.

"It's going to blow up," said a senior Financial Products manager, who spoke on condition of anonymity because he was not authorized to speak for the company. "I have a horrible, horrible, horrible feeling that this is going to end badly."

President Obama yesterday vowed to "pursue every legal avenue to block these bonuses." But that pledge might have came too late. About $165 million in retention payments started to go out Friday to employees at Financial Products, after numerous discussions with the Treasury Department and the Federal Reserve.

Attorneys working for the Fed had been examining the matter for months and determined that the retention payments couldn't be touched because AIG would face costly lawsuits and be subject to penalties from states and foreign governments. Administration officials said over the weekend that they agreed with that assessment. (continue this Washington Post article here)

3.16.2009

Muzzling GOP Chairman Michael Steele

According to the Washington Post: "After two weeks of public drubbing over comments that included criticism of radio host Rush Limbaugh and a reference to abortion as a matter of "individual choice," Steele is taking steps to address some of the concerns about his early gaffes. He has called a halt to his television appearances and curtailed national media interviews."

According to the Washington Post: "After two weeks of public drubbing over comments that included criticism of radio host Rush Limbaugh and a reference to abortion as a matter of "individual choice," Steele is taking steps to address some of the concerns about his early gaffes. He has called a halt to his television appearances and curtailed national media interviews."(source: Washington Post "Steele's Focus Turns to Nuts and Bolts" by Perry Bacon Jr.)

The Real Scandal of AIG

Robert Reich, Former Secretary of Labor and Professor at Berkeley writes in the Huffington Post: The real scandal of AIG isn't just that American taxpayers have so far committed $170 billion to the giant insurer because it is thought to be too big to fail -- the most money ever funneled to a single company by a government since the dawn of capitalism -- nor even that AIG's notoriously failing executives, at the very unit responsible for the catastrophic credit-default swaps at the very center of the debacle -- are planning to give themselves $100 million in bonuses. It's that even at this late date, even in a new administration dedicated to doing it all differently, Americans still have so little say over what is happening with our money.

Robert Reich, Former Secretary of Labor and Professor at Berkeley writes in the Huffington Post: The real scandal of AIG isn't just that American taxpayers have so far committed $170 billion to the giant insurer because it is thought to be too big to fail -- the most money ever funneled to a single company by a government since the dawn of capitalism -- nor even that AIG's notoriously failing executives, at the very unit responsible for the catastrophic credit-default swaps at the very center of the debacle -- are planning to give themselves $100 million in bonuses. It's that even at this late date, even in a new administration dedicated to doing it all differently, Americans still have so little say over what is happening with our money.The administration is said to have been outraged when it heard of the bonus plan last week. Apparently Secretary of the Treasury Tim Geithner told AIG's chairman, Edward Liddy (who was installed at the insistence of the Treasury, in the first place) that the bonuses should not be paid. But most will be paid anyway, because, according to AIG, the firm is legally obligated to do so. The bonuses are part of employee contracts negotiated before the bailouts. And, in any event, Liddy explained, AIG needed to be able to retain talent.

AIG's arguments are absurd on their face. Had AIG gone into chapter 11 bankruptcy or been liquidated, as it would have without government aid, no bonuses would ever be paid; indeed, AIG's executives would have long ago been on the street. And any mention of the word "talent" in the same sentence as "AIG" or "credit default swaps" would be laughable if it laughing weren't already so expensive.

Apart from AIG's sophistry is a much larger point. This sordid story of government helplessness in the face of massive taxpayer commitments illustrates better than anything to date why the government should take over any institution that's "too big to fail" and which has cost taxpayers dearly. Such institutions are no longer within the capitalist system because they are no longer accountable to the market. So to whom should they be accountable? When taxpayers have put up, and essentially own, a large portion of their assets, AIG and other behemoths should be accountable to taxpayers. When our very own Secretary of the Treasury cannot make stick his decision that AIG's bonuses should not be paid, only one conclusion can be drawn: AIG is accountable to no one. Our democracy is seriously broken. (source: Huffington Post)

3.13.2009

Lecturing Jim Cramer

According to the Chicago Tribune: Delivering to Jim Cramer a show-long lecture about the responsibilities of a financial news network, Jon Stewart positioned himself as the thinking man's Rick Santelli, as a guy who's also mad as hell, but at the people who deserve the ire.

In the much anticipated Cramer vs. Stewart showdown on "The Daily Show" Thursday night after a week of public back-and-forth, Stewart wore the populist hat CNBC reporter Santelli tried to don a couple of weeks ago in delivering an on-air "rant," as Santelli called it, against irresponsible mortgage takers.

"They burned the [bleeping] house down with our money," Stewart said, seething, of Wall Street insiders who turned piles of dubious loans into instruments of short-term profit, "and walked away rich as hell, and you guys knew that that was going on."

The crowd at Comedy Central's studio cheered because it was good populism, well aimed and well delivered. And Cramer, the usually peripatetic host of CNBC's "Mad Money," sat and took it, mostly, like a schoolboy willing to let the teacher go on in hopes of still being allowed to graduate.

Stewart creamed him, if anything almost to a fault. He urged Cramer and his newschannel brethren to report rather than blindly trust what CEOs say (Cramer's primary defense of CNBC's lack of vigilance). But, really, Stewart didn't report himself; he delivered a 22-minute opinion column, occasionally interrupted by Cramer shoulder shrugs, "okays," and mea culpas plus, bringing in financial TV in general, wea culpas.

Not that Cramer had much defense to offer. This was his response to the burning down the house comment, Stewart's most passionate: "Okay. Alright. I have a wall of shame [on the show]. Why do I have banana cream pies? 'Cause I throw them at CEOs. Do you know how many times I have 'pantsed' CEOs on my show?"

That's not a defense. It's another count in the indictment, an admission to not taking this stuff as seriously as, we now see, it ought to have been taken.

"It feels like we are capitalizing your adventure," Stewart said to Cramer, a former trader who, Thursday morning, appeared on a show with -- no joke -- convicted criminal Martha Stewart, pounding dough, little gifts that Stewart's writers did not fail to unwrap.

But this really wasn't about getting laughs. Right before the burning house remark, the man Cramer had derisively called a "comedian" showed a video clip of Cramer talking about how to manipulate stock and said, "I understand you want to make finance entertaining, but it's not a [bleeping] game… I can't tell you how angry that makes me, because what it says to me is you all know.... [There's] a game you know is going on but that you go on television as a financial network and pretend it isn’t happening."

He called it "this weird Wall Street side bet" happening on top of, and dwarfing, the public game of whether stock A or B is headed up or down. He kept the focus, almost unrelentingly, on the Wall Street gamesmen and women who turned bad mortgages into epic disaster and, to his credit, tried to indict Cramer and his colleagues en masse, and for failing a broader civic duty.

"I hope that was as uncomfortable to watch as it was to do," Stewart said when it was over.

That, Mr. Santelli, is how you do populist. See the difference between that and standing in a roomful of traders, going after a guy whose house maybe had two more bathrooms than he should have been able to afford?

Funny side note: Late in the show, as things were winding down, ads came on successively for Bank of America, which has seen its stuck tumble in the crisis as it bought more troubled financial firms, and for Apple, the stock of which Cramer seemingly talked about being able to influence in one of "Daily Show's" clips.

Rick Santelli's Misplaced Populism

SANTELLI: "The government is promoting bad behavior! How this, president and new administration, why didn't you put up a website to have people vote on the Internet as a referendum to see if we really want to subsidize the losers' mortgages or would we like to at least buy cars and buy houses in foreclosure and give 'em to people that might have a chance to actually prosper down the road and reward people that could carry the water instead of drink the water."

SANTELLI:"This is America! How many of you people want to pay for your neighbor's mortgage that has an extra bathroom and can't pay their bills? Raise their hand. President Obama, are you listening?"

Rick Santelli's Clip from 2/19/2009

Chris Matthews asks the Question: “Who'd ya vote for Rick”

MATTHEWS: OK, let‘s go around it a couple ways. First of all, do you believe the problem here of these over two million people out there facing foreclosure, who are at the bottom of this toxic asset problem, which is at the bottom of our financial crisis, which is the bottom of our economic crisis today and the reason we‘re going into something close to a Depression—so let‘s get at it.

We got a bunch of people out there can‘t afford their houses they‘re living in. Is it their fault because they‘re deadbeats, they shouldn‘t have bought the houses, or is the guy who sold them the house, the woman who sold them the house—was that person a huckster who got them to buy the house with phony-baloney low interest rates, with no down payment, and guess what, allowed them to lie on their application and claim an income they didn‘t have? Who‘s responsible, the huckster or the deadbeat?

SANTELLI: Everybody. You know what?

MATTHEWS: No, no, no. No, no, no. No. You‘re an analyst. Who‘s largely responsible for the problem of these two million cases of toxic assets which are weighing down our financial system and may bring us all to financial hell? Who‘s responsible?

SANTELLI: Well, Chris, think about it. Were these mortgage brokers -

were they licensed? Was there any supervision there? No, OK? Did the people that signed these have their lawyers look at them? If not, shame on them, OK? Chris Matthews, do you sign something without reading the fine print or having a lawyer look over a housing contract? Have you had a lawyer for all your contracts closing on all your properties? Have you?

MATTHEWS: Am I supposed to answer that question? Yes. Occasionally, I find myself not reading the fine print. But let me ask you a question. Did you vote for Obama or McCain?

SANTELLI: I voted for Mr. McCain. It should be between me and my...

MATTHEWS: OK, I‘m just trying to...

SANTELLI: But I did. And you know what? This isn‘t a left or right issue, though.

MATTHEWS: No, I want to know where you‘re coming from politically because you‘re coming down hard on Barack. That‘s all I‘m asking for.

Then, Jim Cramer jumps onto Rick Santelli's bandwagon on MSNBC's Hardball:

BARNICLE: How did it get to this point? How did so many people miss so many signs just over the last year-and-a-half, never mind six or seven years ago, in terms of the housing boom and the mortgages to people who couldn‘t afford them, just the last year-and-a-half? How did so many smart people miss so many stop signs?

CRAMER: There was so much money made, Mike, it wasn‘t worth seeing the stop signs. You could make so much money on one of these trading desks or mortgage desk that, frankly, you stopped caring about your client. Now, I mean, look, I—look, I said that Bank of America (INAUDIBLE) do better than the government, but Bank of America, CitiBank, they all—if you were on the trading desk—I used to be on a trading desk—you could make $5 million, $6 million, $7 million, and it wouldn‘t—you‘d do it in three years. You‘d gaffe (ph) every one of your clients, and then you go home. And we had a level of greed that was only equaled by the amount of money you made. So there was just too much money to be made, Mike. It was just too bountiful.

SANTELLI: “I don‘t think it‘s right in America to reward people that made the wrong decisions. Send them to classes on how to read the small print, but I think that the greater bulk of this country should be getting something and being taken care of and not ignored.”

Okay Messrs. Cramer and Santelli, the losers that couldn't read the “small print” seems to be your Wall Street cronies and their partners in crime the banking sector. Obviously the Wall Street investment houses couldn't read or balance their books, hence trillions of dollars in losses. Clearly the bankers couldn't read the small print as they wrote and approved trillions of dollars in subprime and predatory mortgages. Most certainly, the goof balls on Wall Street couldn't read the small print when the retail bankers and other assorted nefarious lenders dumped DDD-junk and called it AAA-paper. What a bunch of losers on Wall Street. They come to the government with their pants around their ankles begging the government for a handout so the taxpayers of America can subsidize their bogus banking practices.

The one thing that they really, really do teach in business school is how to read a balance sheet. Reading and understanding various spread sheets and ratios is the basis for ALL of the business classes. It's like being a doctor and not knowing how to read a thermometer and blood pressure machine or what those numbers mean. So who is really the “loser” the highly trained professionals in the finance sector or an unsuspecting prospective homebuyer. Either you are a professional or you're not. Can you even read a balance sheet. If so, then why the full scale financial meltdown? Who was really asleep at the switch the passengers or the pilot.

No, Rick Santelli and Jim Cramer, America really doesn't want to bailout “losers.” The problem is that America sees Wall Street, Investment Houses, Bankers and their enablers like CNBC as the perverted losers in this equation.

3.11.2009

Jon Stewart vs. Cramer

Visit msnbc.com for Breaking News, World News, and News about the Economy